As I discussed in Trust Issues - Part I, trust plays a key role in our investment process. But equally important is the culture that supports it. A strong, adaptable culture ensures that fund managers not only remain rational and clear-eyed in their decision-making but also build businesses capable of withstanding the unpredictability of the market. In this part, I explain how we turn this cultural assessment inward and why it matters in fund management.

How Culture Shapes Outcomes

In fund management, culture is more than just a companion to trust; it is the foundation that makes trust possible. A culture that promotes open debate, discipline, and mutual respect leads to better decision-making and greater resilience, which are essential for navigating market complexities. Track records are often seen as proof of competence, but they don’t capture the full picture. While they provide insight into performance and decision-making, they don't reveal how internal dynamics and culture shape those outcomes.

Trust is earned gradually, often through consistent results. The longer a fund manager maintains a solid track record, the more confidence investors gain in their abilities—confidence which often grows through network effects. Success attracts more AUM, creating a feedback loop that amplifies trust. But trust can break down quickly when results fail to meet expectations, especially when explanations lack transparency or suggest denial. In such a context, the absence of a strong culture can be fatal.

While track records show how managers perform, they don’t reveal the internal culture driving those decisions. Consistency in outcomes depends heavily on a stable, well-functioning culture. Investors look for cultures that reflect the same discipline and rationality they expect in the management of their assets. Without that, even the strongest track record can be undermined. In the long run, a bad culture can undo years of good performance, making it clear that culture is just as critical as the strategy itself.

The Cult Of Personality

For years, the market has idolized star fund managers, elevating them to guru status based on their market instincts. When performance is good, these personalities shine. However, a prolonged period of underperformance starts to chip away at this status. When mistakes are inevitably made, they start looking a bit more... human.

We believe the market places too much emphasis on the cult of personality. We are wary of experience and intuition, as it’s just a short step to overconfidence. Intuition is a powerful mental shortcut when it works—research shows it is most helpful in fields where the rules of the game are clear and consistent, like chess—however, in complex, probabilistic fields, it often fails us. The lack of process and logic behind intuition makes it almost impossible to untangle skill from luck.

The Star Fund Manager: A one-MAN show

To do well consistently, fund managers need an investment style that matches their personalities and risk tolerances—one that lets them sleep well at night. Growth investors may squirm where contrarians thrive. Throwing both together under one strategy is likely to create friction, and too much friction is unhelpful in an industry where decisions often need to be made quickly. And some people dislike their decisions being questioned. Big egos have less tolerance for challenges—it is more comfortable to avoid. Conflict also increases the risk of fund manager turnover, which erodes trust with clients.

One-man shows come with the tempting prospect of higher rewards. When times are good, it’s easy to attribute success to personal foresight and collect all the winnings. In contrast, teams often face issues when attributing a track record. Blame and resentment can fester when things don’t turn out as planned. If a fund manager leaves, it can be unnerving—it is hard for clients to understand the impact on future performance.

This explains why one-man shows have ruled the stage for so long—fast moves, all the glory, all the blame. But as markets grow more unpredictable, the solo path is becoming increasingly fragile.

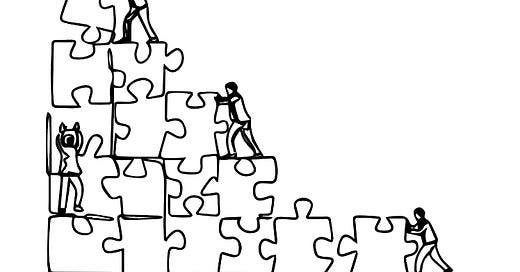

It Takes a Village: The Rise of Collaborative Fund Management

The power of teams lies in their diversity of perspectives, something that is hard for solo fund managers to replicate. While it’s true that a lone manager might benefit from full control and receive higher rewards when things go well, a team-based approach offers a more sustainable path. Different personalities bring healthy friction, challenging biases and leading to smarter decisions.

The burden on a solo fund manager can feel heavy when times are bad. The stakes are high, and careers can unravel quickly. For most, dealing with such stressors alone is worse than sharing the burden. A team can troubleshoot together, call out each other’s biases, and encourage each other to remain disciplined when it is needed most.

The friction introduced when different personalities work together can be healthy. It slows down ‘diagnostic momentum’—a threat to good decision-making.

Flat teams—without dominance hierarchies—are better at living with uncertainty and balancing conflicting views. A single, dominant voice rips away healthy dissonance, giving the illusion of certainty. That’s not to say it is impossible for an individual to reach a balanced view on their own. Philip Tetlock, of “Superforecasting” fame, has shown that some people are unusually good at this—a matter of temparment and outlook. But he also shows that it is much easier in a team. We suspect a team of individuals—who buy into the same investment philosophy and are temperamentally open to debate—will have an easier time remaining resilient and adaptable in an ever-shifting market context.

Shared Accountability: We Are All In The Same Boat

Removing competitive tensions is key to keeping ego out of the picture. Collective ownership of decisions is better than individual scorekeeping. This requires trusting your teammates and taking responsibility for the team’s outcome, not just your individual contribution. From our experience, assembling people with the right temperaments for this can take time, but it is a worthwhile investment. Get it wrong, and the dynamic quickly becomes toxic and unstable. Aligned goals and incentives are crucial here, as they ensure that team members are working towards the same objectives and assessing outcomes similarly. Without shared values and principles, even the most skilled individuals can't form an effective decision-making group.

We believe a more team-oriented approach lowers key-person risks and provides safeguards against bias and ego. Each of our decisions passes through at least three portfolio managers, each person ensuring a slightly different perspective. We vote as a committee, recording our views for post-mortem analyses. Consensus ideas are treated with caution via a devil’s advocate function. We use small position sizes and many bets, making it easier to admit errors and lower sunk cost bias.

Trust Us, We've Got This

In fund management, trust is built on consistent performance. But consistency itself is a product of a strong culture. Teams that prioritize collective intelligence and open debate are more likely to adapt to market shifts and avoid the pitfalls of overconfidence.

As more women and diverse voices enter the fund management world, the opportunity to improve our collective intelligence increases. A team approach makes this more sustainable. Adaptability to life events—such as parental leave—is critical for women’s career progression and normalising the same for men. In contrast, a solo setup makes it nearly impossible to maintain this level of adaptability.

Communication is another critical element of trust. A culture of open debate is underpinned by finding comfort in admitting errors. Improving over time requires tracking and analysing these errors. We spend more time discussing—internally and externally—our mistakes than our wins. This is more likely to reveal our biases and lead to the greatest lasting improvements in decision-making. Of course, this level of transparency can be uncomfortable for everyone. We all prefer for things to appear easy—to brush mistakes under the carpet as insignificant or one-off. But we want to partner with people who understand that investing is a game of probabilities. Our goal is to continually improve the odds in our favor by tackling uncomfortable truths and learning from them.

- Afaf

Disclaimers:

This blog post is provided for informational purposes only and does not constitute investment advice, financial advice, or any other type of advice. The information contained herein is not intended to be a substitute for professional advice, including but not limited to investment or financial advice. The content presented in this blog post reflects the personal views and opinions of the authors at Heuristik and it may not necessarily represent the views of any other individual or entity.

Investing in financial markets involves risk, including the risk of loss. Past performance is not indicative of future results. Before making any investment decisions, it is important to conduct thorough research and consider seeking advice from a qualified professional, such as a licensed financial advisor or investment manager.

Heuristik is not a registered investment advisor, broker-dealer, or financial institution. We do not endorse or recommend any specific investment products, services, or strategies.

Readers are encouraged to exercise caution and discretion when implementing any information or strategies discussed in this blog post. We disclaim any liability for any loss or damage resulting directly or indirectly from the use of or reliance on the information presented herein.

By accessing this blog post, you acknowledge and agree that Heuristik shall not be held liable for any damages or losses arising from your use of or reliance on the information presented herein.

Copyright © 2024 Afaf Auf. All rights reserved.

For further enquiries:

a.auf@heuristikcapital.com